Urban Living, Smart Investing: A Guide to Apartments & Units

Unlock the potential of high-demand urban markets with a low-maintenance, accessible investment.

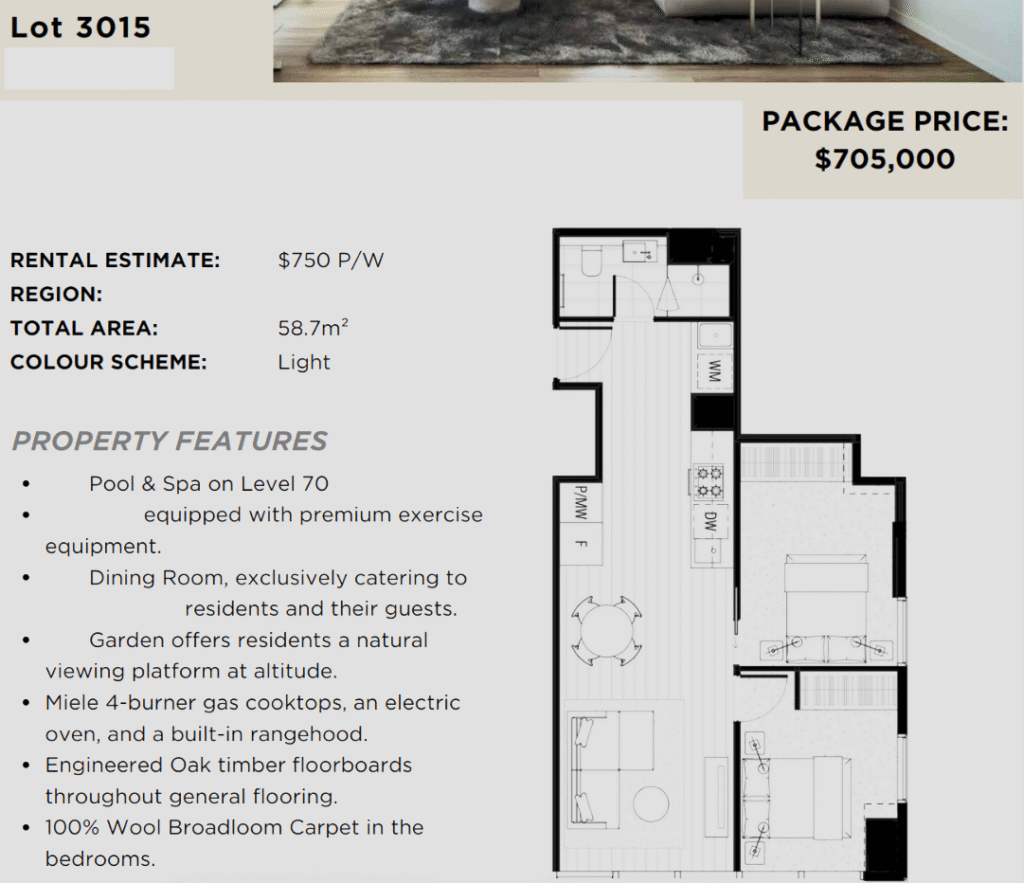

Apartment Floor Plan Example

What is an Apartment or Unit?

An apartment or unit is a self-contained residence that occupies part of a larger building or complex. As an investment, it offers a more accessible entry point into prime urban and suburban locations. These properties are managed by a central body corporate (or strata), which handles the maintenance of all common areas, lifts, and building exteriors, making it a popular “lock-and-leave” style of investment.

Who is this Strategy Best For?

- First-Time Investors: The lower purchase price compared to a standalone house makes it an attainable first step onto the property ladder.

- Yield-Focused Urban Investors: Apartments in central locations often attract high rental demand from students and professionals, ensuring consistent cash flow.

- Time-Poor or “Hands-Off” Investors: With the body corporate managing external maintenance, it’s a very low-effort asset to own.

The Trade-Offs: An Unbiased Analysis

The Advantages

- Affordability: A lower capital outlay is required, making it easier to enter high-demand, inner-city markets.

- Strong Rental Demand: Proximity to employment hubs, universities, and lifestyle amenities ensures a large and consistent pool of potential tenants.

- Low Maintenance: No need to worry about mowing lawns, painting exteriors, or fixing the roof—the strata fees cover this.

The Considerations

- Ongoing Strata Fees: Body corporate or strata fees are a significant and ongoing cost that must be factored into your cash flow calculations.

- Slower Capital Growth: As you own very little to no land, apartments typically experience slower capital growth compared to houses.

- Less Control: You have limited control over the building’s appearance, rules, and the timing of major repairs.