The “Middle Ground” Power Play: Investing in Duplexes & Townhouses

Combine the benefits of house-like living with the efficiencies of a multi-dwelling property.

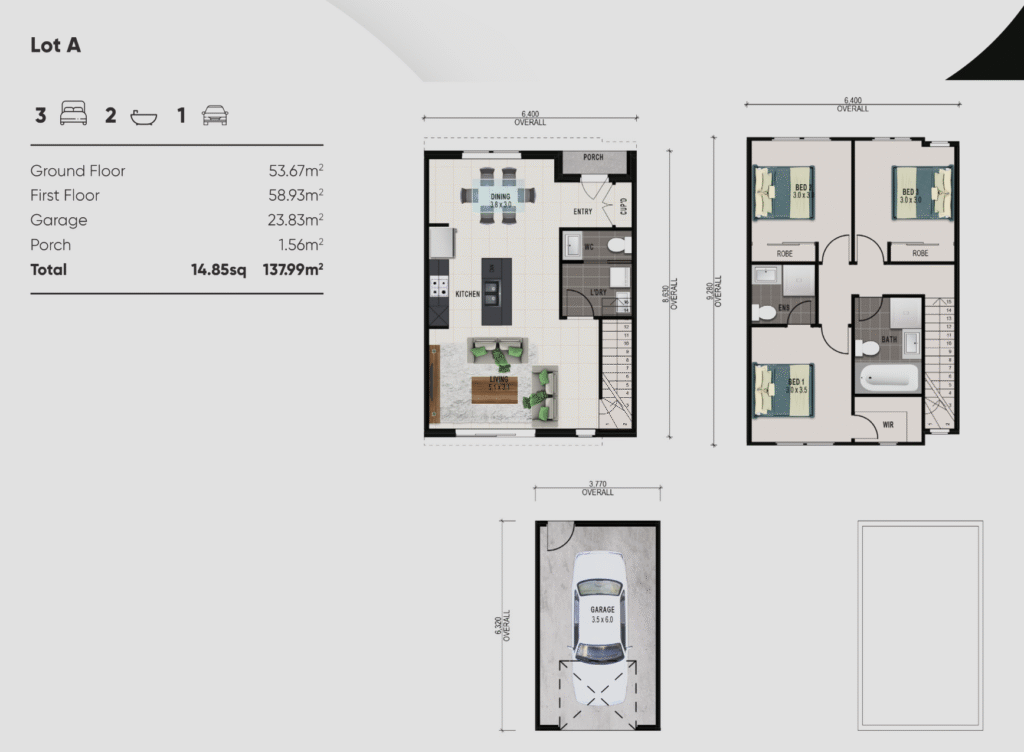

Townhouse Floor Plan Example

What are Duplexes and Townhouses?

These properties represent a popular “middle ground” in the housing market. A duplex is a single building divided into two separate homes, often on strata title, allowing them to be owned and sold individually. A townhouse is a multi-story home that shares side walls with its neighbours in a complex. Both offer more space and privacy than an apartment, while being more affordable and lower-maintenance than a traditional standalone house.

Who is this Strategy Best For?

- Balanced Growth & Yield Investors: Those looking for a blend of capital growth from the land component and strong rental income.

- Investors Targeting Families & Professionals: The extra space and private outdoor areas are highly attractive to small families and professionals.

- Small-Scale Developers: Building a duplex can be a powerful strategy to create two saleable assets from a single block of land.

The Trade-Offs: An Unbiased Analysis

The Advantages

- Land Component: Unlike an apartment, you own the land your dwelling sits on (or a significant share), which is the primary driver of long-term capital growth.

- High Tenant Appeal: The combination of space, privacy, and modern design makes these properties highly desirable to a broad range of quality tenants.

- Depreciation Benefits: As new builds, they offer significant tax depreciation benefits on both the building and the fittings.

The Considerations

- Strata/Body Corporate Fees: Like apartments, most duplexes and townhouses are part of a strata scheme and incur ongoing fees.

- Shared Walls & Spaces: You share common property and walls with your neighbours, which can sometimes lead to disputes or noise issues.

- Higher Price Point: They are more expensive than apartments in the same area.