Unlocking Your Backyard: The Granny Flat Investment Strategy

Instantly create a dual-income property and supercharge your cash flow by adding a secondary dwelling.

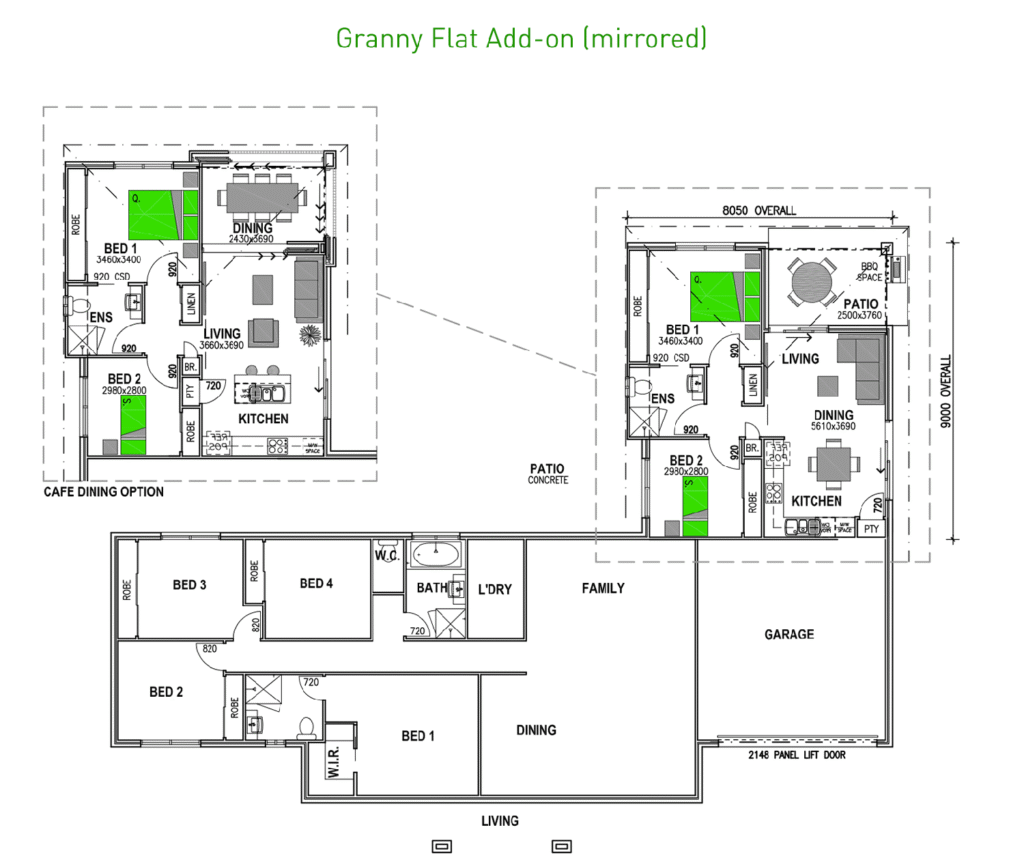

Granny Flat Floor Plan Example

What is a Granny Flat Strategy?

A granny flat, or secondary dwelling, is a powerful strategy for “manufacturing” equity and cash flow on an existing property. It involves building a small, self-contained home in the backyard of a larger block. In many council areas across Australia, these can be rented out to generate a second income stream, effectively turning a standard single-income property into a high-yielding, dual-income asset.

Who is this Strategy Best For?

- Existing Homeowners & Investors: Those who own a property on a suitably sized block and are looking to maximize its financial performance.

- Cash Flow Focused Investors: This is one of the fastest and most effective ways to significantly boost the rental yield of a property.

- Families Seeking Flexible Solutions: Perfect for housing teenagers, university students, or elderly relatives on the same property.

The Trade-Offs: An Unbiased Analysis

The Advantages

- Instant Equity & Value Add: A well-built granny flat can immediately add significant value to your overall property.

- Massive Cash Flow Boost: The cost of construction is often paid back quickly through the high rental yield of the second dwelling.

- No Additional Land Cost: You are leveraging an asset—your land—that you already own.

The Considerations

- Strict Council Regulations: Approval is entirely dependent on your local council’s specific rules regarding size, zoning, and parking.

- Impact on Privacy: Adding a second dwelling reduces the size and privacy of the backyard for both sets of tenants.

- Financing Challenges: Securing finance for a granny flat construction can sometimes be more complex than a standard home loan.