The Dual-Income Strategy: A Guide to Dual-Key Properties

Maximize your rental yield and accelerate your portfolio growth with a single, powerful asset.

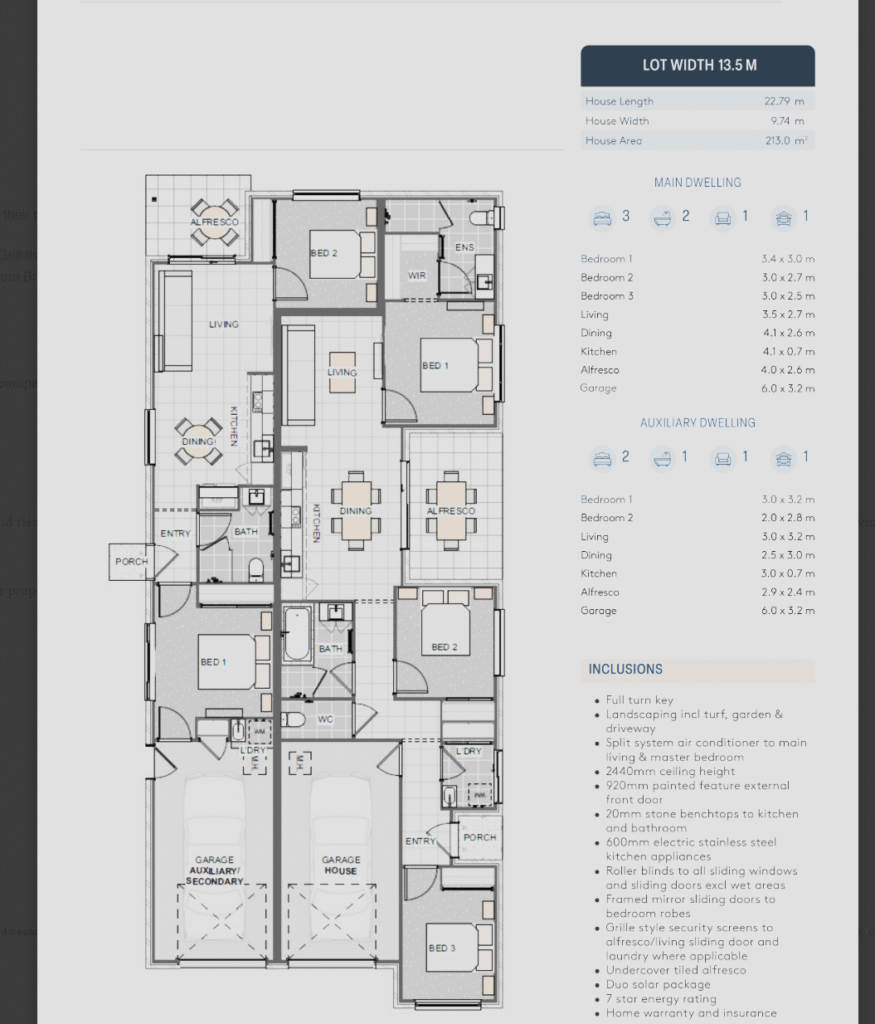

Dual-Key Property Floor Plan Example

What is a Dual-Key Property?

A dual-key property is a single property on one title, intelligently designed to contain two separate, self-contained residences. This typically includes a main dwelling (e.g., a 3-bedroom home) and a smaller, secondary dwelling (e.g., a 1-bedroom unit), each with its own private entrance, kitchen, and bathroom. You own one property, but you collect two rental incomes.

Who is this Strategy Best For?

- Yield-Focused Investors: Those looking to generate the highest possible cash flow from a single asset.

- Multi-Generational Families: Ideal for families who want to live together while maintaining privacy, such as housing elderly parents or adult children.

-

“Live & Invest” Homeowners: Live in one residence and rent out the other, using the rental income to significantly offset your own mortgage (a strategy known as “house hacking”).

The Trade-Offs: An Unbiased Analysis

The Advantages

- Superior Cash Flow: Two rental incomes from one property dramatically increase your rental yield compared to a standard home.

- Lower Entry Costs: You pay stamp duty and council rates on only one property, not two.

- Diverse Tenant Appeal: Attracts different types of tenants (e.g., a family in the main house, a single professional in the unit), reducing vacancy risk.

- Future Flexibility: You can sell the property as a single asset, live in one part, or rent both.

The Considerations

- Higher Initial Outlay: The construction cost is higher than a standard home of a similar size.

- Potentially Lower Capital Growth: The total resale value may grow slower than two separate, individual properties in the same area.

- Management Intensity: You are managing two sets of tenants, which can be more work.

- Location is Key: This strategy is most effective in areas with strong rental demand from diverse demographics, such as near universities or hospitals.